A short guide to employee CPF contribution in Singapore

Most Singaporeans are already familiar with the Central Provident Fund (CPF) since a portion of their earnings is deposited into their CPF accounts. When you're an employer, the mechanics of CPF are a little different.

If you've recently started your business in Singapore and aren't aware of how CPF works, you've come to the correct spot. We guarantee that by the conclusion of this post, you will be an expert on employee CPF contribution.

What is CPF?

Short for “Central Provident Fund”, CPF is a mandatory, social security savings plan. Employers deduct contributions from employees’ salaries every month. The CPF contributions can be used for housing, insurance, investment, and education. All Singaporeans are expected to make monthly payments to the fund, which invests the revenues on their behalf for their future benefit, under the CPF plan.

The CPF is open to all Singaporeans, including citizens and permanent residents (PRs), who are above the age of 18. Like bank savings accounts, CPF funds yield interest, enabling the CPF account holders or members to increase their money.

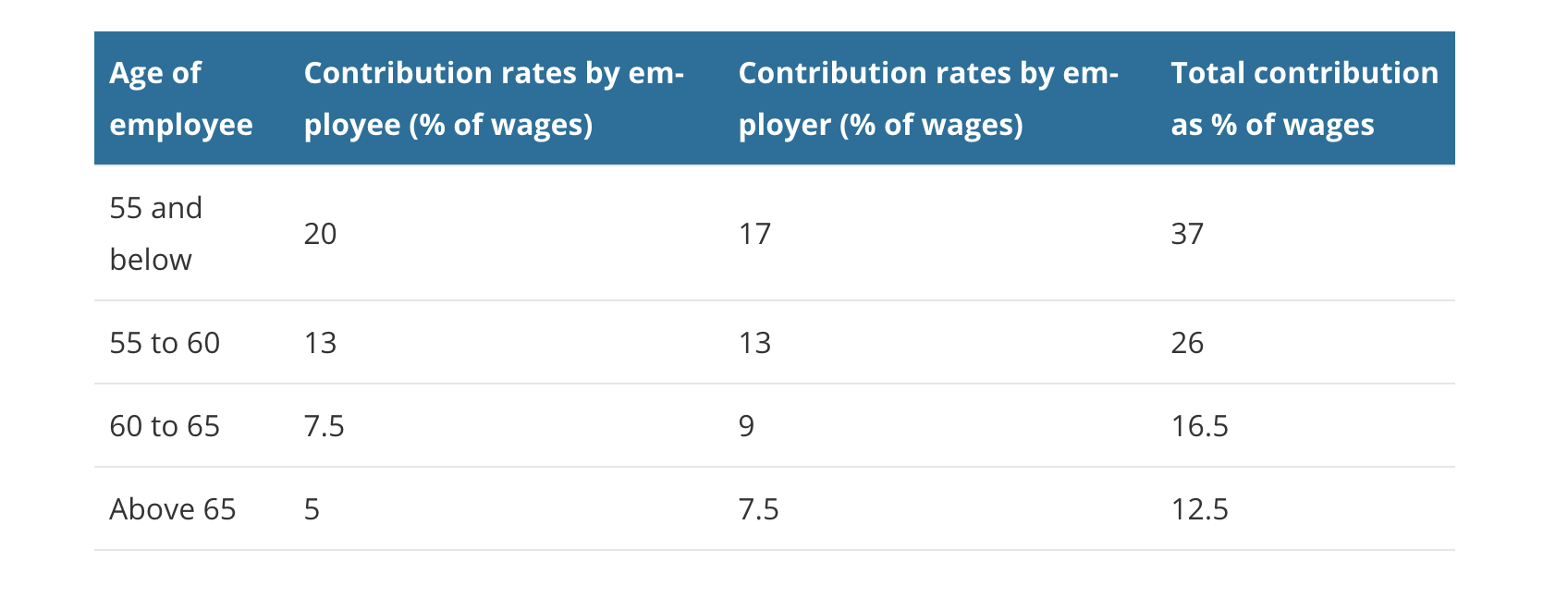

Employees get up to 17% of their income in CPF contributions from their employers, on top of the 20% they contribute from their earnings. It’s not possible to withdraw money from one's CPF account unless there are exceptional conditions in place. Such as,

- Your life expectancy has been significantly decreased as a result of your condition.

- You are permanently unable to do any kind of work

- According to the Mental Capacity Act, you are permanently unable to make decisions due to a lack of mental capacity.

The CPF also serves as a response to three primary needs: retirement, property ownership, and basic healthcare coverage.

How does the CPF work?

Employees earning more than S$500 per month are required to deposit a percentage of their income to their CPF account under the terms of the plan. The rates of contribution differ according to age, with rates gradually decreasing from the age of 55 onwards. Individuals who work abroad, on the other hand, are exempt from this since CPF payments are not required in this situation.

Employee CPF contributions to their CPF accounts are matched by their employers, who must make a separate payment to each employee's CPF account. The rate of the contribution made by the employer differs depending on the age of the individual.

CPF contributions and allocations

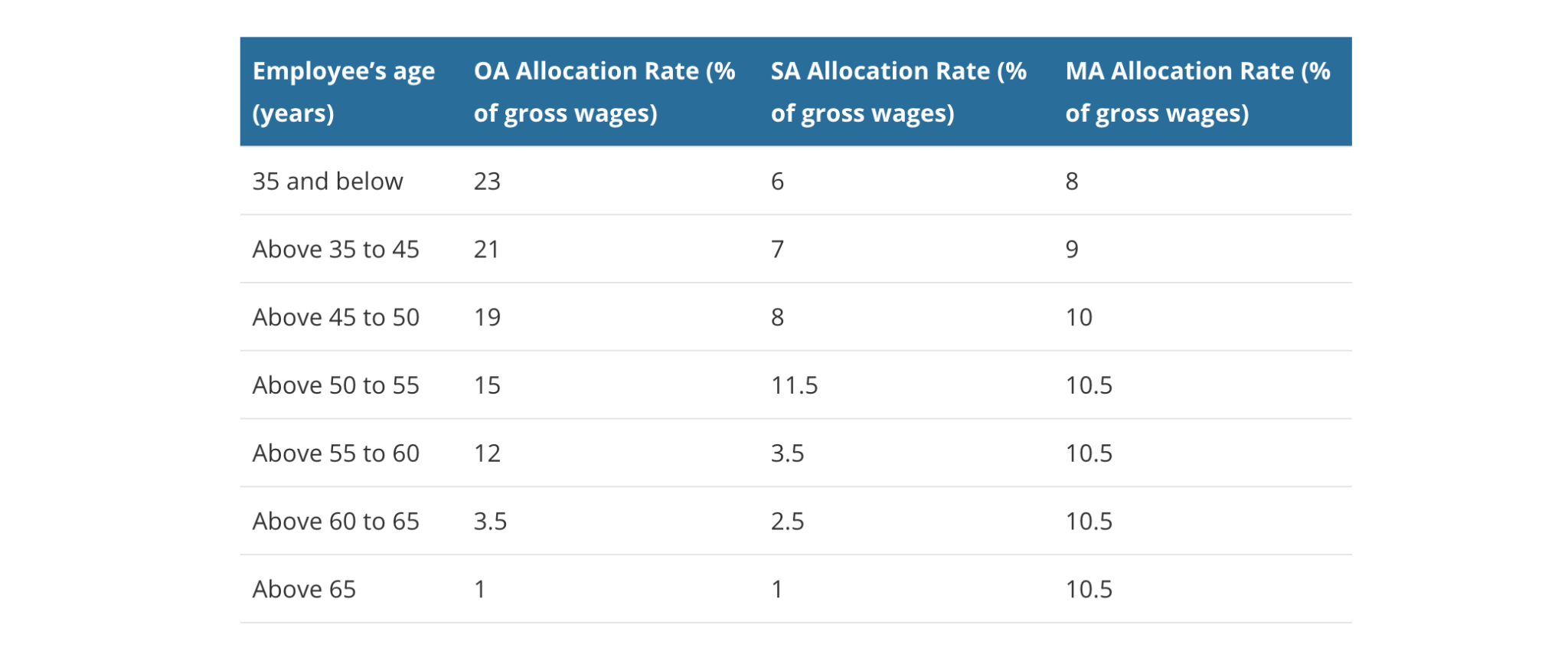

Everyone who joins the CPF has given three accounts: the Ordinary Account (OA), the Special Account (SA), and the Medisave Account (MA). They also have access to a fourth account, the Retirement Account, when they reach the age of 55.

When they are between the ages of 35 and 55, this distribution starts to shift. As you start to think about retirement and possible health care costs, you'll start to put more money into your SA.

Staff members between the ages of 55 and 65 are the last group to see a change. Their pay falls along with their employers'. This is the last thing that will happen: Employees who are 65 and older will see most of their contributions go to an MA that will pay for their health care.

The rates of CPF allocation for the various age groups are shown in the following table:

Between 35 and 55 years, this allocation shifts, with a bigger allocation toward your SA as they begin to plan for retirement and probable healthcare bills. Employees between the ages of 55 and 65 are experiencing the final shift, as their rates of contribution decline along with those of their employers. Lastly, the majority of employee payments beyond the age of 65 will go to their MA to cover their medical expenses.

Conclusion

Although CPF is a bit complicated– the plan is critical to the well-being of every Singaporean and permanent resident. Even if you have no plans to leave Singapore soon, either for professional or personal reasons, you must make the most of your CPF funds while you’re still here in Singapore.

For employers, it’s good to have a payroll system that allows online submission of employees’ CPF contributions.

Unit4 Prosoft is a reliable payroll software solution that enables easy calculations for taxes, overtime, and Central Provident Fund (CPF) deductions.